A Brief History of Fiscal Responsibility

While crisis economics requires government spending to lessen the damage done to average Americans, sound fiscal policy requires several long-term strategies. Over the last thirty years, Washington policy makers, like American businessmen, have put short-term, temporary gains ahead of long-term, sustainable progress. Solving our problems requires a clear understanding of America’s fiscal history. Liberalism solved our fiscal problems. Conservatism made them worse.

It’s an old adage that an ounce of prevention is worth a pound or cure. Collapsing financial markets don’t have to be expensive. We’ve known about financial bubbles since the 1700s, when the Amsterdam market create a bubble in tulip bulbs. Luckily, the limited nature of the market meant that the collapse impacted relatively few people.  This began to change in the 19th century as financial instruments crept into more and more parts of the overall economy and bank failures occurred almost very 20 years.

To stabilize the banking industry Congress created the Federal Reserve in 1913. It was designed to set monetary policy, or set the level of the money supply. The value of the total money supply was determined by a fixed amount of goods and property in the entire county. The idea was that the money supply needed to accurately reflect the amount of wealth in the county. As the country grew so should the money supply.

The early Federal Reserve was reluctant to interfere with values assigned by local bankers. This reluctance meant that the Federal Reserve inadvertently contributed to the financial bubble of the late 1920s. Without transparent bookkeeping or adequate capital requirements, banks simply lent vast sums of money to Wall Street speculators. The Fed had the tools to dampen this enthusiasm, but it decided to let the market determine values. As we now know, this was a huge mistake.

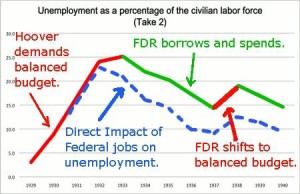

Unlike the Amsterdam tulip bubble, the American stock market crash had a huge impact on average Americans and average working people around the world. Most governments at the time, including the US government, were controlled by conservatives.  They responded by cutting spending and trying to balance their budgets. They believed the government spending crowded out private investment. Even as late as 1932 President Herbert Hoover told the nation:

The results were unfortunate. Unemployment continued to climb from 1929 to 1933, and voters lost confidence in leaders who pleaded helplessness and patience. The US was spared the fate of Germany, which voted to militarize it’s society under Adolf Hitler, because Franklin Delano Roosevelt believe government intervention in the economy could make average people’s lives better.

FDR sweep into office after two years of Hoover’s free market policies with 57% of the vote. FDR promised a country facing 25% unemployment a government committed to “bold, persistent experiment . . . above all try something.”

The liberal president started by stabilizing the financial industry, shepherding through Congress Glass-Stegall, the FDIC and the Securities and Exchange Commission. The American people had lost faith in unregulated capitalism, and he wanted to restore trust in an economy founded on private property. Glass-Steagall created firewalls between financial, commercial and insurance companies. If trouble started in one, the trouble would be less likely to spread to another.  Besides insuring depositors, the FDIC set capital requirements and open bookkeeping rules for consumer banking. The SEC was designed to make sure stock sales were honest and open to big and small investors alike. FDR intervened in the economy to lessen the impact of another financial meltdown and to secure the money supply.

If FDR had stopped their his popularity with voters would surely have plummeted. He pushed ahead with job programs like the WPA, CCC and the TVA. One little known CCC project was in southeastern Oklahoma, the Corps reforested nearly the whole section of the state. Private companies had simply clear cut the entire region, leaving it in ruin. By replanting the trees, the federal government created a sustainable local and private economy which exists to this day.

One of the best known projects was the Tennessee Valley authority. It is a series of damns that not only provided immediate jobs but also made rural electrification possible. Private companies saw no profit in rural American. The government, under Roosevelt, was not driven by profit; it was driven to fulfill it’s constitutional mandate to promote the general welfare.

FDR demonstrated that sound monetary and fiscal policies could pull America out of a depression. He successfully reversed the failed policies of Herbert Hoover who was paralyzed by the belief that the government should do nothing.

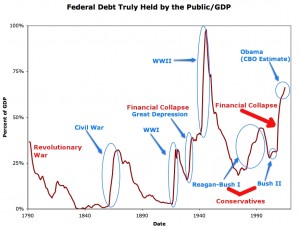

Unfortunately, for the country, the public costs of the cleaning up the financial mess and fight a second world war, left a debt burden well over 100% of GDP.  This shocking figure could have caused panic, but it did not. Washington policy makers and voters continued to follow FDR progressive legacy. Even Ike, Americans first republican president since Hoover, embarked on massive public works project called the interstate highway system. Ike also understood the military value of healthy kids and supported the federal school lunch program.

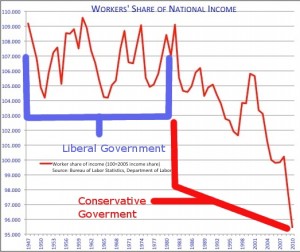

What happened the the debt to GDP ratio? Did it skyrocket and bankrupt the country as conservatives like Barry gold water predicted? Did it lead the country down the road to totalitarianism like the Austrian school predicted. No. Liberal/progressive policies created the largest middle class the world had ever know. Banks flourished without a single crisis from 1929 to 1988.  Public investments in computers and aerospace created whole new private opportunities. Activist courts required Southern states to obey the constitution requirements of equal protect of laws and due process.

America was working better than the founders could have every dreamed and the debt burden fell.

The oil shocks of the 1970s, the loss in Vietnam and Watergate, however, opened the door for reactionary change. It appeared as if a country that could do no wrong, suddenly, could do no right. While most politicians looked around for policy solutions, Ronald Reagan stepped forward with sound bites. Energy problems, blame the environmentalist. Job losses, blame excessive federal regulations and unions. Rising interest rate, blame federal spending. Reagan’s answers were so simply that they had to be true. Reagan talked about prayer and respecting the flag. Liberals, like communist, hated God, spit on soldiers and burned the flag.

When Reagan won the 1980 election with 50.7% of the vote (less than Obama’s 52.9%), he declared a revolutionary victory. His goal was nothing less than the unraveling the FDR’s New Deal. Instead of “punishing successful businessmen,” he would reward them but cutting their taxes and freeing them for burdensome regulations and unions.

The results were predictable. Budget deficits skyrocketed and public debt began to rise for the first time since the end of World War Two. The middle class faced an opposite fate. It began to shrink, facing increasing job insecurity and falling wages.

Reagan got lucky, however. Western oil companies struck black gold on the Alaskan north slop and the North Sea during the 1970s. These two new field, along with a energy conservation laws put in place by President Jimmy Carter, broke OPEC’s ability to manipulate oil prices. As energy prices collapsed, inflation and interest rates returned to normal.  Reagan triumphantly proclaimed that “it’s morning in America again.”

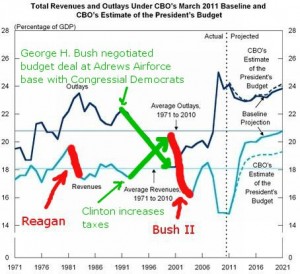

After the civil rights turmoil of the 1960s and the oil shortages of the 1970s the country breathed a collective sigh of relief and reelected Reagan to a second term by an overwhelming margin. Reagan didn’t, however, push ahead with his revolution. In fact, he had to retreat. His extravagant military spending, tax policies and faith in the free market were simply unsustainable.

Tax cuts were only part of the Reagan legacy. Looking down the road, policy analysts could see a looming train wreck. The baby boomers were going to create a spending bubble, and Reagan’s tax corporate and marginal tax cuts had drained federal revenue.   President Reagan and Tip O’Neil “solved” the problem by raising Social Security taxes, effectively transferring the tax burden from the top to the bottom.

Reagan’s successor, George H. Bush won his election by promising, “Read my lips, no new taxes.” While this made good politics, it was bad policy.  For the first time in American history, the deficit was growing without a major war or a sever economic crisis. Once in office, Bush struck a deal with Congressional Democrats to fix the budget deficit by raising marginal income tax rates and cut spending.

Another Reagan mess, which Bush and Congress had to clean up, was the Savings and Loan collapse. S&Ls successfully lobbied to deregulate their industry. Free of New Deal era restrictions, they recklessly invested in commercial real estate, contributing to a bubble market.  When the predictable collapse occurred, the Federal government once again had to intervene to mitigate the damage to average Americans. Congress created the Resolution Trust Corporation, which had the authority to seize failed S&L, liquidate their assists and pay off depositors.

In 1992 many Republican primary votes did not forgive Bush for compromising with Democrats and cast him as a Rhino (Republican in Name Only). They preferred tax cuts over actual deficit reduction and voted for Pat Buchanan to express their sense of betrayal. Bill Clinton was able to capitalized on the divide in the Republican party when Ross Perot made an independent bid for the presidency. A the center of the race was the budget deficit.

While Clinton won the election with less than 50% of the vote, Democrats controlled both Houses of Congress. The House Republicans decided to avoid Bush’s electoral fate and pledge themselves to oppose the Clinton deficit reduction plans. The 1993 plan required higher taxes on the wealthiest 1% of Americans and cut taxes for the small businesses and 15 million low income families.

Not a single Republican voted in favor, claiming the Clinton budget would kill jobs. Those predictions were simply wrong. Not only did Clinton set America on the path to fiscal responsibility for the first time sine the Reagan Revolution, but the economy grew at annual 3.2 rate (adjusted for inflation) and 11.6 million new jobs.

Clinton and his Vice President, Al Gore, also looked towards a new economy. They touted a new program during their election campaign called the information superhighway. It was meant to remind Americans that government spending on infrastructure (Erie Canal, TVA, and the interstate highways) spurred economic development. Clinton and Gore were right. Public investments in the internet opened up new business opportunities for the private sector.

In 1994 Republicans once again capitalized on the anti-government mode of the country and voters turned control of the Congress over to Newt Grinch. His famous 1996 memo explained his strategy. He demonized Democrats and lionized Republicans. While Reagan warned his supporters never to say a bad word about fellow Republicans, Gingrich warned his supporters nerve to say a kind word about the “enemy”.

The initial results of the Gingrich Revolution was disastrous. Unwilling to compromise as the Constitution required, Conservatives tried to bully Bill Clinton. When he stood firm, Gingrich refused to pass a budget and shut down the government. This experience taught him a lesson; Americans hate government in theory but like it in practice.

Unfortunately, Bill Clinton had already surrender the rhetorical high ground, famously saying that the era of big government was over. Clinton worked with Republicans on welfare reform, lower capital gains taxes, NAFTA and banking reform. Welfare reform and capital gains were relatively modest changes. NAFTA and banking reform did real long term damage. NAFTA pull a nail in the coffin for the rural American textile industry, and banking reform opened the door for mega banks to consolidate finance and insurance markets.

At the end of the Clinton Presidency the country looked fiscally sound. As new revenue came into the treasury from increased taxes and economic growth, the budget deficit began to shrink.  All federal revenue, including Social Security taxes, had actually produced a surplus.

In 2000 voters faced a clear choice when it came to fiscal responsibility. Al Gore wanted to put the Social Security surplus in a lock box, effectively paying down the Reagan era debt. George W. Bush wanted the emulate the mythical Reagan and redeem his family name after the treachery of his father.  Bush promised one again that tax cuts at the top would trickle down, producing even further deficit reduction.

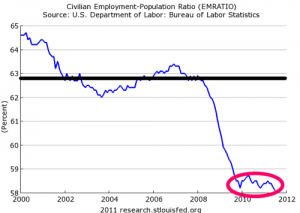

He was wrong. Not only did the budget deficit begin to balloon immediately but job prospects began to decline. From 2000 to 2008 the employment-population ratio dropped from 64% to 59%. This fact was masked by unemployment calculations which ignored people who gave up on the job market.

Today, we are back at square one, debating issues that were settled in the 1930s. We have almost 100 years of economic and political experiences which shows us what works and what doesn’t. Insanity is doing things over and over, expecting different results. Failed conservative policies are destroying the middle class. Doubling down on them will not make things better. They will make things worse, much worse.  American needs proven fiscal responsibility, not fairy dust.

Comments

You must be logged in to post a comment.